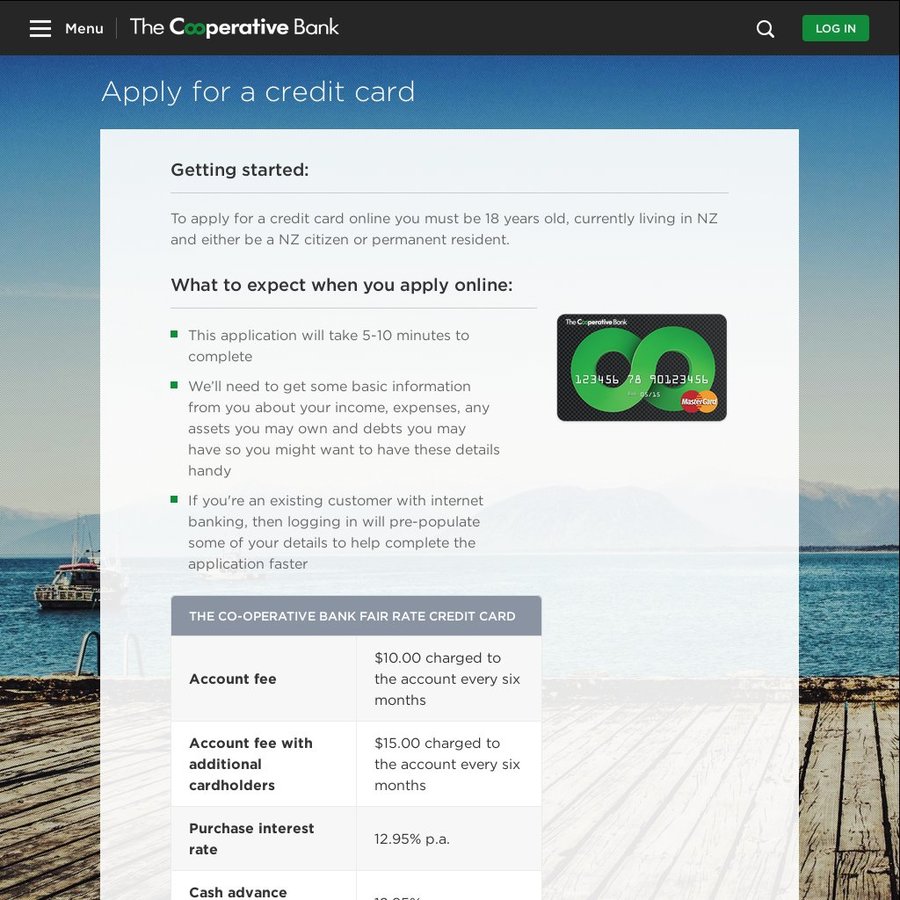

get your cash advance

What is the FHA Loan Restrict for the Kentucky?

If you are looking order your first family within the Kentucky, otherwise have seen problem within the qualifying having a traditional home loan previously, a keen FHA loan into the KY can be a good option. These finance is insured by U.S. bodies and offer versatile borrowing standards, low down repayments, and competitive rates to assist provide towards another home or to refurbish your family.

What is actually an enthusiastic FHA Financing?

A keen FHA loan is actually home financing that’s supported by the fresh U.S. Government Construction Management (FHA). These types of funds give available investment so you’re able to consumers whom you are going to if you don’t feel rejected getting a classic Kentucky mortgage on the bank. Regulators support implies that Kentucky FHA lenders can offer aggressive pricing, low-down percentage standards, and much more flexible credit scoring standards than with conventional mortgage loans.

By the relaxed borrowing from the bank standards and aggressive terms and conditions, FHA fund inside KY are a great option for the initial-go out household buyer , recent graduate, or for family with has just defeat financial hardships.

Benefits associated with Kentucky FHA Fund

- Versatile borrowing from the bank criteria: You would not end up being immediately disqualified for having a low borrowing from the bank get, minimal credit history, otherwise a past bankruptcy. For as long as your application suggests in charge shell out designs, uniform money, and you may an excellent FICO with a minimum of 500, you may still qualify for a home loan .

- Low down costs: The minimum deposit to own a proper-certified customer with a beneficial Kentucky FHA home loan try step 3.5% of price. This is less than brand new deposit needed for many other mortgages, and you will makes it easier to possess more youthful customers or men and women in place of an effective large offers to gain access to homeownership.

- Aggressive cost: Given that FHA try insuring the borrowed funds, lenders appreciate decreased economic chance. It indicates most aggressive prices to your borrower which can competitor old-fashioned mortgages.

- Versatile framework: Towards the FHA 203(k) program, you can make use of your own Kentucky FHA financing so you can wrap the house pick, as well as people needed home improvements and you will fixes, with the one particular mortgage. There are even alternatives for adjustable- and fixed-price structures, based on your needs.

In the event the such advantages seem like what you’re shopping for from inside the an effective home loan, we advice downloading the newest Griffin Gold software to monitor the borrowing from the bank, song profit, and develop an action plan to buy your fantasy family.

FHA Financing Conditions from inside the Kentucky

KY FHA mortgage criteria are usually more versatile than others of traditional mortgages. Here are the primary earliest requirements that must definitely be satisfied to utilize:

- Credit history: To discover the best possible opportunity to safe an approval with a great step 3.5% downpayment, your credit rating shall be no less than 580. FICOs as low as five hundred are considered, nevertheless might need to built a larger down percentage usually at least 10% to help you offset the higher risk.

- Deposit: Try to inform you the capacity to generate good 3.5% so you can ten% down-payment, according to stamina of financial software.

- Regular a position and you can money: A couple of years value of uniform a career is required, together with constant money. There is absolutely no lowest money needed, therefore recent graduates and people who has actually has just altered work may however be considered.

- Debt-to-money proportion (DTI): Your own DTI is a simple computation of your own month-to-month revenues (before fees try applied for) you to goes to paying expenses and you may debts. Kentucky FHA loan providers are looking for an ideal DTI off zero more than forty-five%. Although not, DTIs of up to 57% will always be thought.

- Assets requirements: When using an agent to find the perfect domestic, you’ll want to keep during the FHA loan limit towards the respective condition when you need to end a larger down-payment. Your house also have to meet up with the status criteria place by the FHA to ensure the home is secure, voice, and you may structurally safer.

Inside Kentucky, the brand new FHA loan restrict statewide try $498,257 to have an individual-home, no matter what its physical venue in the condition.

The newest FHA financing constraints are ready by the HUD (U.S. Service off Construction and you can Urban Creativity) according to median home values by county or populace city. If a certain town is recognized as highest costs, the newest limit could be increased accordingly. Only at that writing, although not, the high quality limit enforce statewide.

Ideas on how to Apply for an enthusiastic FHA Home loan for the Kentucky

Griffin Financing specializes in Kentucky FHA lenders, possesses spent some time working to help make the cash advance america in Pleasant Valley Connecticut application processes effortless. Here is what we offer once you implement:

Work on a dependable FHA Bank inside Kentucky

Regardless of if many Kentucky lenders provide FHA finance, of many don’t possess new deep training otherwise detailed feel wanted to smoothly browse the process. Griffin Funding is actually satisfied to concentrate on FHA home loans, and also be an excellent spouse inside the working to to have the dream about homeownership.

Pertain now first off the process and you will possess difference out of coping with an effective Kentucky FHA financing expert. To each other, we could help you to get into the very first family, refurbish or re-finance your existing family, or do an action plan to set your up towards the most useful recognition later.