Bookkeeping

Book Value Per Common Share BVPS: Definition and Calculation

There are other factors that you need to take into consideration before making an investment. However, book value per share can be a useful metric to keep in mind when you’re analyzing potential investments. The figure of 1.25 indicates that the market has priced shares at a premium to the book value of a share. The ratio may not serve as a valid valuation basis when comparing companies from different sectors and industries because companies in other industries may record their assets differently.

Book Value Per Share vs. Market Stock Price: What is the Difference?

This article is prepared for assistance only and is not intended to be and must not alone be taken as the basis of an investment decision. Please note that past performance of financial products and instruments does not necessarily indicate the prospects and performance thereof. A company’s future earnings potential is taken into consideration when calculating the market value per share (MVPS), as opposed to BVPS, which uses past expenses. To put it another way, a rise in the anticipated profits or growth rate of a business should raise the market value per share. It excludes value of intangible assets from book value of shareholders’ equity used in the normal book value per share calculation. If the book value is based largely on equipment, rather than something that doesn’t rapidly depreciate (oil, land, etc.), it’s vital that you look beyond the ratio and into the components.

- You shouldn’t judge a book by its cover, and you shouldn’t judge a company by the cover it puts on its book value.

- In contrast, video game companies, fashion designers, or trading firms may have little or no book value because they are only as good as the people who work there.

- If a business is presently trading at $20 but has a book value of $10, it is being sold for double its equity.

- Kindly note that this page of blog/articles does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

- The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

How Can be Book Value Per Share Increased?

It is important to analyse other financial indicators and market developments rather than using them individually. Many share market apps offer various tools for stock market investment nowadays which may help you find out what is good PB ratio for a company.. Investors should do extensive study and consider a variety of aspects before making a selection, just like they should with any other investment. Second, the net worth of an organization’s assets must be ascertained by investors. To do this, they must subtract the total value of all debts and liabilities from the book values of all the assets shown on a company’s balance sheet. If a business earns 500,000 and spends 200,000 of that money on assets, then the value of the common stock rises along with the BVPS as well.

Recent Articles

The market value per share is a company’s current stock price, and it reflects a value that market participants are willing to pay for its common share. The book value per share is calculated using historical costs, but the market value per share is a forward-looking metric that takes into account a company’s earning power in the future. With increases in a company’s estimated profitability, expected growth, and safety of its business, the market value per share grows higher. Significant differences between the book value per share and the market value per share arise due to the ways in which accounting principles classify certain transactions.

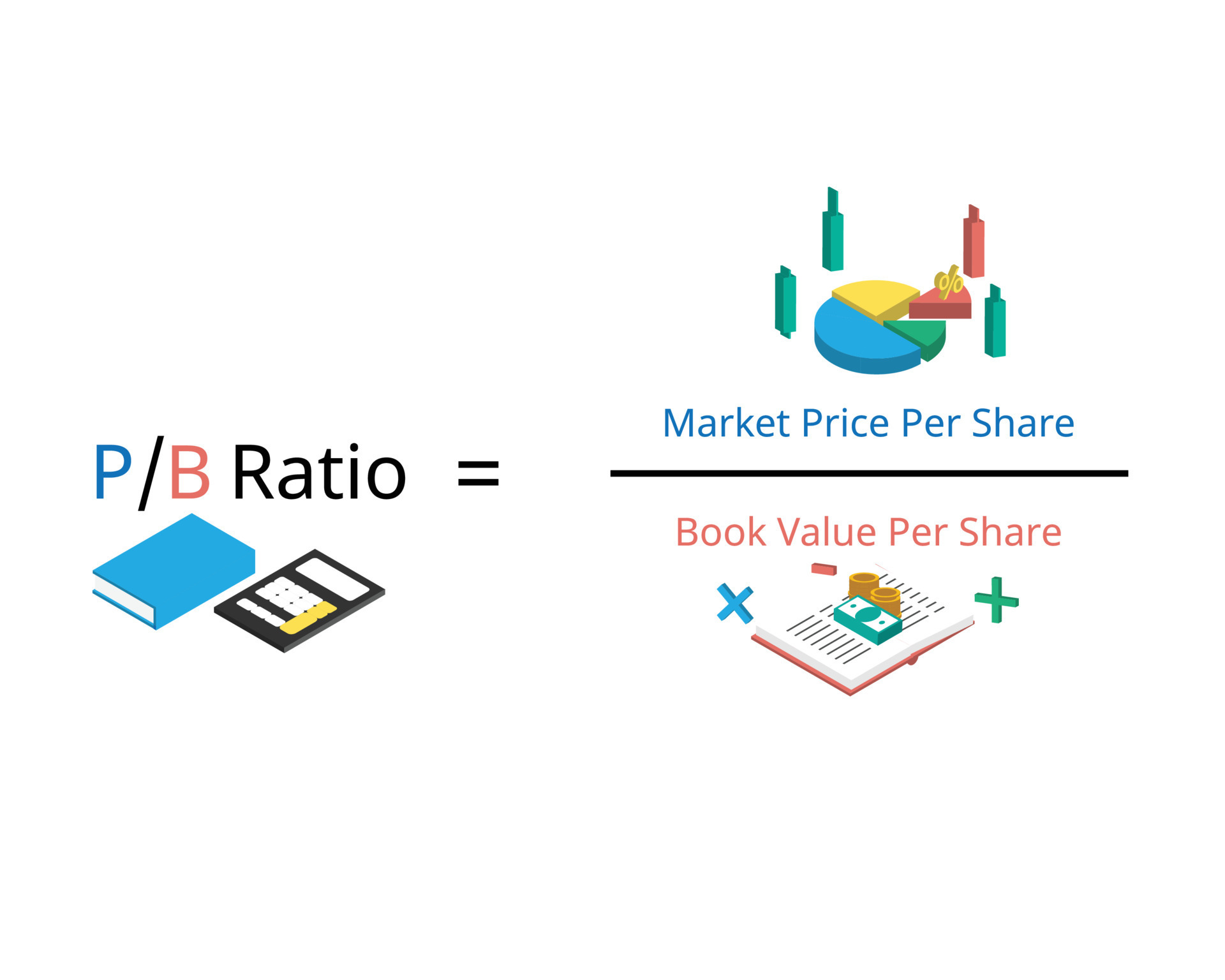

If XYZ saves 300,000 in liabilities by using that money, the company’s stock price rises. The denominator is book value per share, and the example is known as the price to book value (P/B). The market price, as opposed to book value, indicates the company’s future growth potential.

Book value is the value of a company’s total assets minus its total liabilities. The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. BVPS is 2020 review of xero practice manager what shareholders receive if the firm is liquidated, all tangible assets are sold, and all liabilities are paid. To get BVPS, you divide the figure for total common shareholders’ equity by the total number of outstanding common shares.

BVPS is theoretically the amount shareholders would get in the case of a liquidation in which all physical assets are sold and all obligations are satisfied. However, investors use it to determine if a stock price is overvalued or undervalued based on the market value per share of the company. Stocks are deemed cheap if their BVPS is greater than their current market value per share (the price at which they are currently trading). As a result, investors must first determine the market capitalisation of a company by multiplying the current market price of its stocks by the total number of outstanding shares. Price-to-Book ratio or PB ratio is a common financial indicator for helping investors determine the company’s worth. Investors can use the PB ratio to evaluate if a stock is overpriced or undervalued to its book value.

Earnings, debt, and assets are the building blocks of any public company’s financial statements. For the purpose of disclosure, companies break these three elements into more refined figures for investors to examine. Investors can calculate valuation ratios from these to make it easier to compare companies. Among these, the book value and the price-to-book ratio (P/B ratio) are staples for value investors. The Book Value Per Share (BVPS) is the per-share value of equity on an accrual accounting basis that belongs to the common shareholders of a company.

You also need to make sure that you have a clear understanding of the risks involved with any potential investment. We’ll assume the trading price in Year 0 was $20.00, and in Year 2, the market share price increases to $26.00, which is a 30.0% year-over-year increase. The next assumption states that the weighted average of common shares outstanding is 1.4bn. For companies seeking to increase their book value of equity per share (BVPS), profitable reinvestments can lead to more cash. In return, the accumulation of earnings could be used to reduce liabilities, which leads to higher book value of equity (and BVPS).

When computing ROE on a per-share basis, book value per share is also utilized in the calculation. Book value per share (BVPS) is a measure of value of a company’s common share based on book value of the shareholders’ equity of the company. It is the amount that shareholders would receive if the company dissolves, realizes cash equal to the book value of its assets and pays liabilities at their book value.

Wir bieten replica uhren legal von bester Qualität über 10 Jahre und 3 Jahre Garantie auf jede Uhr, kostenlosen Versand und ohne Rückgabegrund.