Bookkeeping

Times Interest Earned Ratio Analysis Formula Example

As a point of reference, most lending institutions consider a time interest earned ratio of 1.5 as the minimum for any new borrowing. The investment return you could have gotten if invested in Lockheed in 2010 would be 661%. This result can be easily verified by knowing the historical stock price and by using our famous return of your investment calculator.

What does a times interest earned ratio of 10 times indicate?

Yes, the TIE ratio can vary significantly depending on the industry. Capital-intensive industries with higher debt levels may have lower TIE ratios. Lenders often use the TIE ratio to determine whether a company is a good candidate for loans. A higher ratio makes a company more attractive to lenders. Our comprehensive collection ensures that users can find the perfect tool to meet their needs, no matter how niche or complex. We regularly update our Hub with tips and guides covering different aspects of business and finance.

Real examples: Lockheed Martin Corp vs. Boeing Company

- Earnings before interest and tax (EBIT) is the income left after the business has paid it’s operating expenses.

- The ratio is a financial metric that measures the ability of a business to pay its interest obligations on outstanding debt.

- Companies use a variety of metrics to measure their financial health.

- Other financial metrics would be more applicable in such cases.

- Expenses include things like building fees and the cost of goods sold.

- A low TIE ratio suggests that the company may struggle to cover its interest expenses, indicating higher financial risk.

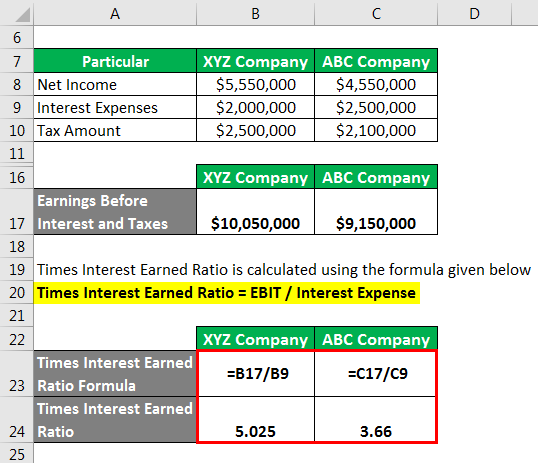

This is a detailed guide on how to calculate Times Interest Earned (TIE) ratio with thorough interpretation, example, and analysis. You will learn how to use its formula to determine a business debt repayment capacity. Therefore, this company XYZ has a times interest earned of 2, meaning that Company XYZ income is 2 times greater than the annual interest expense. The interest coverage ratio (ICR) is preferred to be calculated by quarters, but it is the same result with yearly data. Yes, a company can improve its TIE ratio by increasing its earnings (EBIT) or reducing its interest expenses through debt restructuring or paying off debt. For companies without debt or minimal interest expenses, the TIE ratio may be less relevant.

Interpretation & Analysis

The Times Interest Earned Ratio is a vital financial metric for evaluating a company’s ability to meet its debt obligations. By calculating the TIE ratio, you can gain valuable insights into a company’s financial health and risk profile. Whether you’re an investor, creditor, or business owner, understanding and monitoring the TIE ratio can help you make informed decisions to ensure long-term financial stability. The times interest earned (TIE) ratio is a solvency ratio that determines how well a company can pay the interest on its business debts.

But even a genius CEO can be a tad overzealous and watch as compound interest capsizes their boat. This ratio indicates how many times EBIT covers the interest expense for the period of time you are checking. Note that for Lockheed Martin, the coverage ratio is high and stable.

Times interest earned ratio formula and how it works

The business decides to issue $10 million in additional debt. Its total annual interest expense will be (4% X $10 million) + (6% X $10 million), or $1 million annually. With our user-friendly interface, solving even the most intricate problems becomes a breeze.

However, this can vary by industry and economic context. In other words, a ratio of 4 means that a company makes enough income to pay for its total interest expense 4 times over. Said another way, this company’s income is 4 times higher than its interest expense for the year.

The metric uses interest payments because they are long-term fixed expenses. Therefore, if your company finds it difficult to pay fixed expenses such as interest, you could be at risk of bankruptcy. As such, the times interest ratio shows that you may need to pay off existing debt obligations before assuming additional debt. In calculating the ratio, you need to divide your income by the total amount of interest payable on forms of debt, such as bonds. After you calculate this formula, you will see a number that ranks your company’s ability to pay interest expenses with pre-tax income.

It is a measure of a company’s ability to meet its debt obligations based on its current income. The formula for a company’s TIE number is earnings before interest and taxes (EBIT) divided by the total interest payable on bonds and other debt. The result is a number that shows how many times a company could cover its interest charges with its pretax earnings. The Times Interest Earned (TIE) ratio is a financial metric used to measure a company’s ability to meet its debt obligations, specifically interest payments. A higher TIE ratio indicates a greater ability to cover interest expenses, which is a positive sign for creditors and investors. The times interest earned (TIE) ratio calculator is used to assess a company’s ability to meet its debt obligations.

You took out a loan of $20,000 last year for new equipment and it’s currently at $15,000 with an annual interest rate of 5 percent. You have a company credit card for random necessities, forms and instructions with a current balance of $5,000 and an annual interest rate of 15 percent. Your company’s earnings before interest and taxes (EBIT) are pretty much what they sound like.